- The American

people are footing the tax bill for these two organizations as they go

about removing our right to vote. We deserve to know what we are paying for.

- FOAVC has questions regarding apparent discrepancies between the tax records of COS/CFA and federal income tax law.

- FOAVC believes the American people are entitled to know all the facts regarding COS/CFA.

- who is financing Convention of States Project and Compact for America

- how much money is being spent on these groups by other groups

- who benefits financially within COS/CFA, i.e., how much money are the insiders getting

- how much money is being spent on the political campaigns of COS/CFA

- do the financial records of COS/CFA present possible "red flags" for these 501(c)(3) and 501(c)(4) organizations?

- Are other laws effecting COS/CFA being violated?

The Standards of Federal Tax Law

According to the IRS, "To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earning may inure to any private shareholder or individual. In addition, it may not be an action organization, i.e., it may not attempt to influence legislation as a substantial part of its activities and it may not participate in any campaign activity for or against political candidates." According to the IRS ,"To be tax-exempt as a social welfare organization described in Internal Revenue Code (IRC) section 501(c)(4), an organization must not be organized for profit and must be operated exclusively to promote social welfare." The IRS further states that a 501(c)(4) organization, "must operate primarily to further the common good and general welfare of the people of the community." IRS regulations also require that tax-exempt organizations may not be organized for illegal purposes or for purposes which do not promote the general public good.

Under federal law if an organization violates the federal tax law granting 501(c)(3) tax exempt status, the group is automatically denied their status as a 501(c)(4) organization. As prescribed by law penalties for violation of 501(c)(3) or 501(c)(4) tax law can include:

- payment of part or all back taxes owed that have otherwise have been exempt;

- additional fines and penalties and;

- possible fines and/or prison terms levied against members within the organization.

Threat of Retaliation by Convention of States

In his email response to FOAVC's request for their public federal income tax records, attorney Robert Kelly, legal representative for Convention of States threatened FOAVC with unspecified legal action should FOAVC sully the "good name" of Convention of States in publishing the financial records of Convention of States. According to the 2015 tax return the legal firm employed by COS at that time received one million dollars in legal fees or nearly one-fifth of its total operating budget for the year. FOAVC is unaware of any past or current legal action against Convention of States, its officers or its members. Under federal law 501(c)(3) and 501(c)(4) organizations must make available IRS tax forms designated as "Open to Public Inspection" to members of the public upon request however that request is phrased or worded. Whether any organization which seems intent on seizing control of the federal amendatory process and depriving the American people of their right to vote can have a "good name" is a subject open to debate.

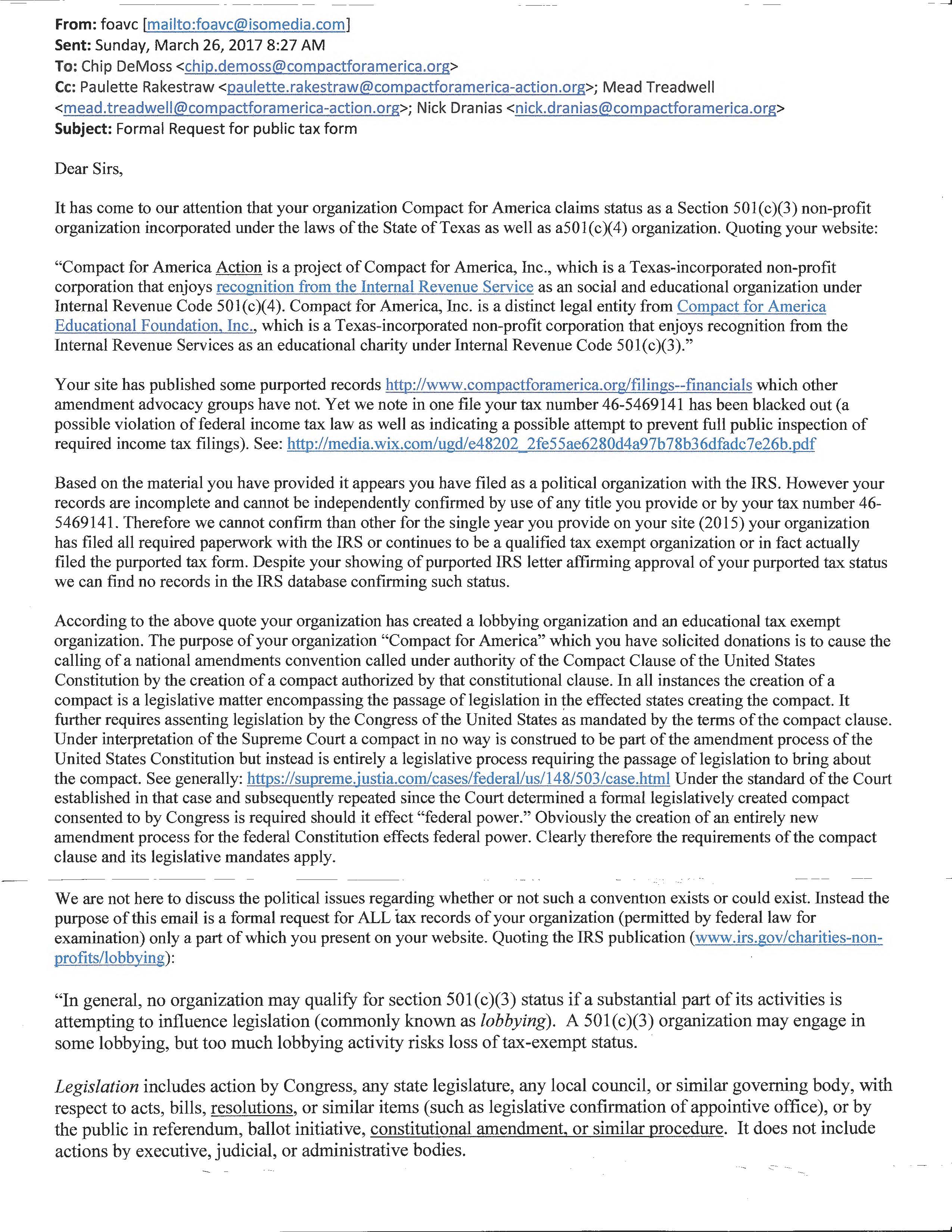

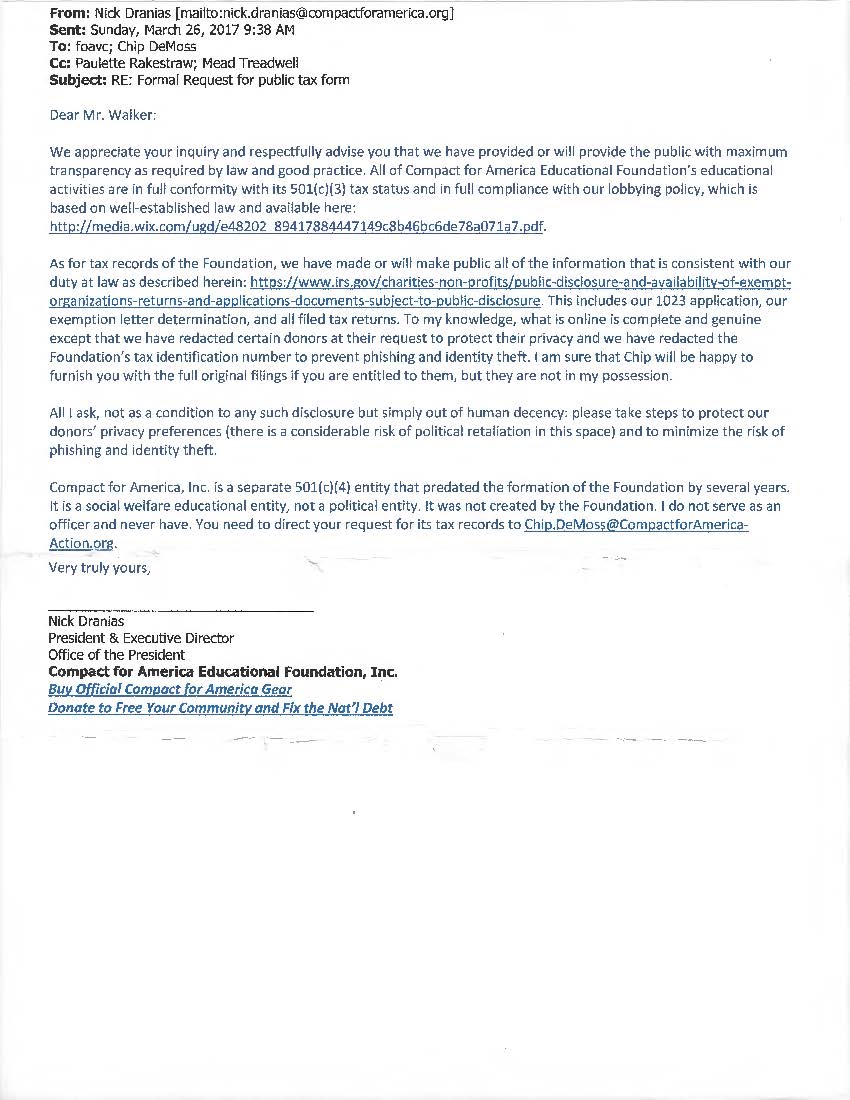

CFA -- Nick Dranias Emails

|

|

|

|

|

|

PDF File--Nick Dranias Emails

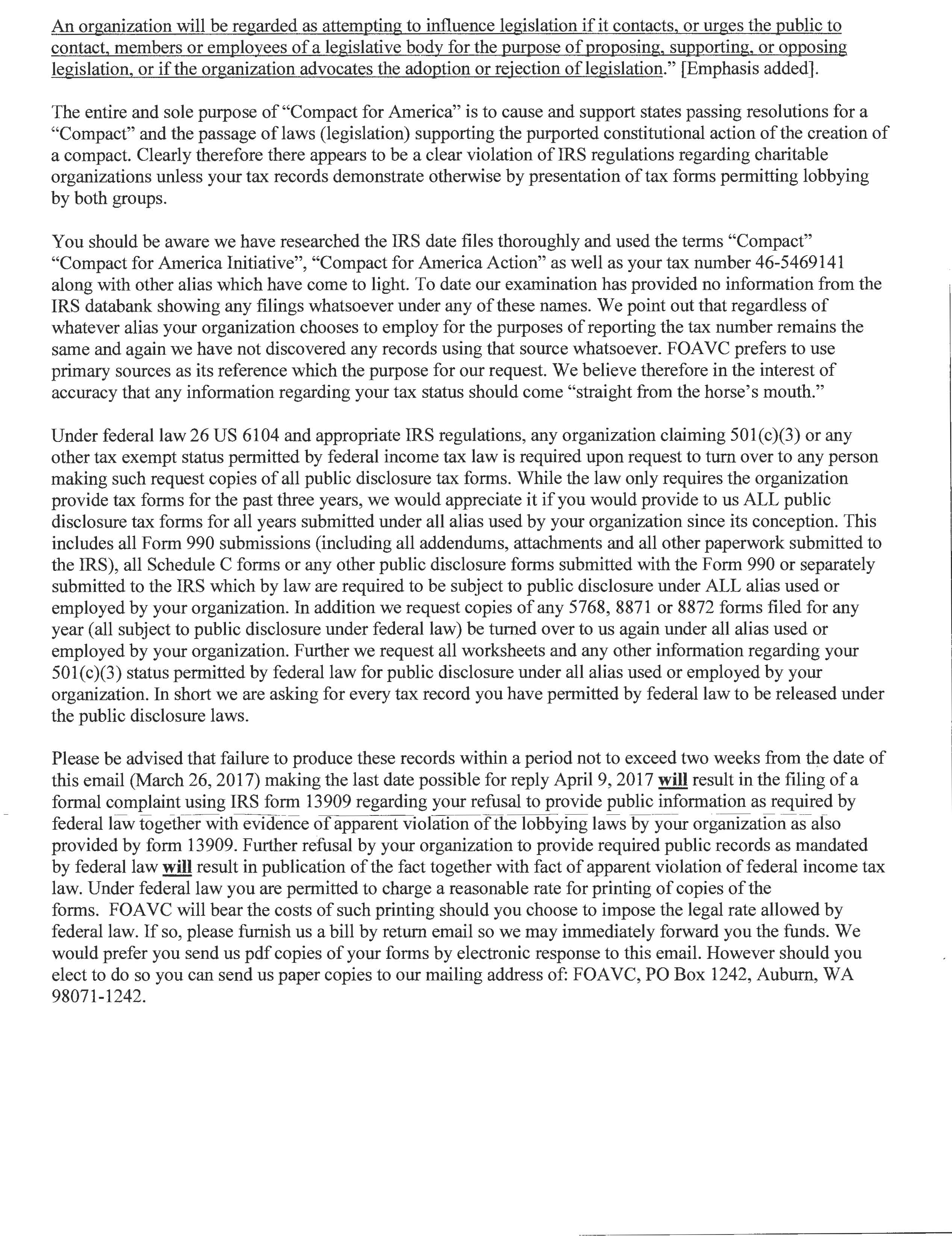

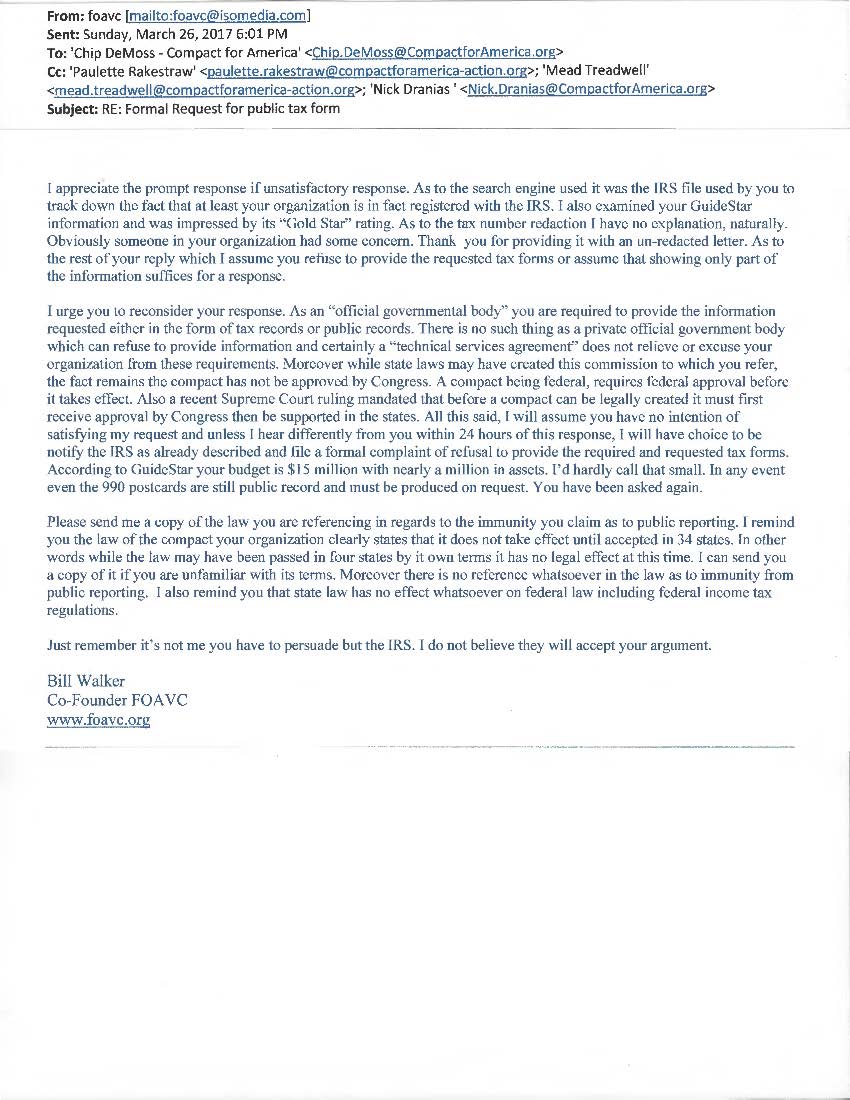

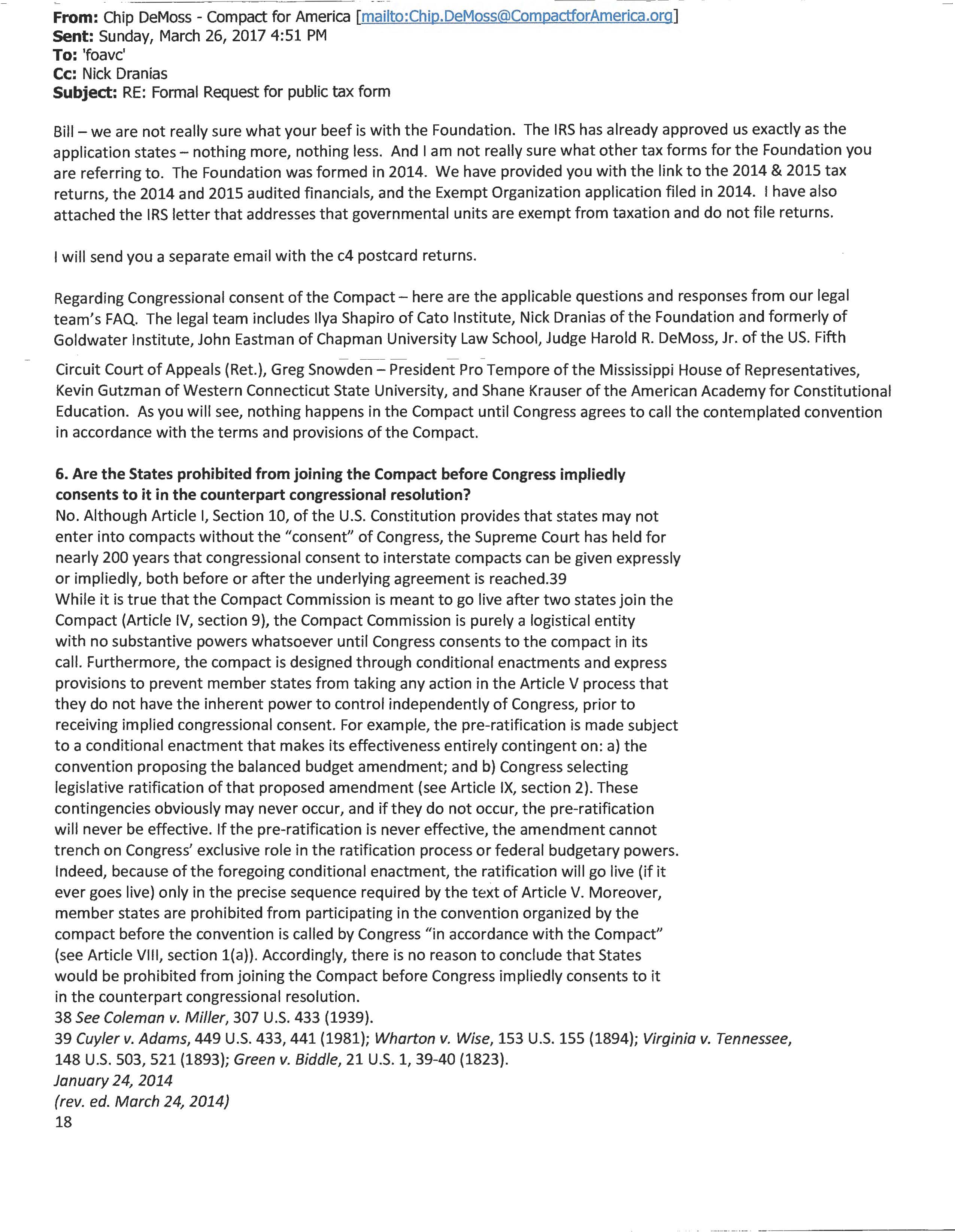

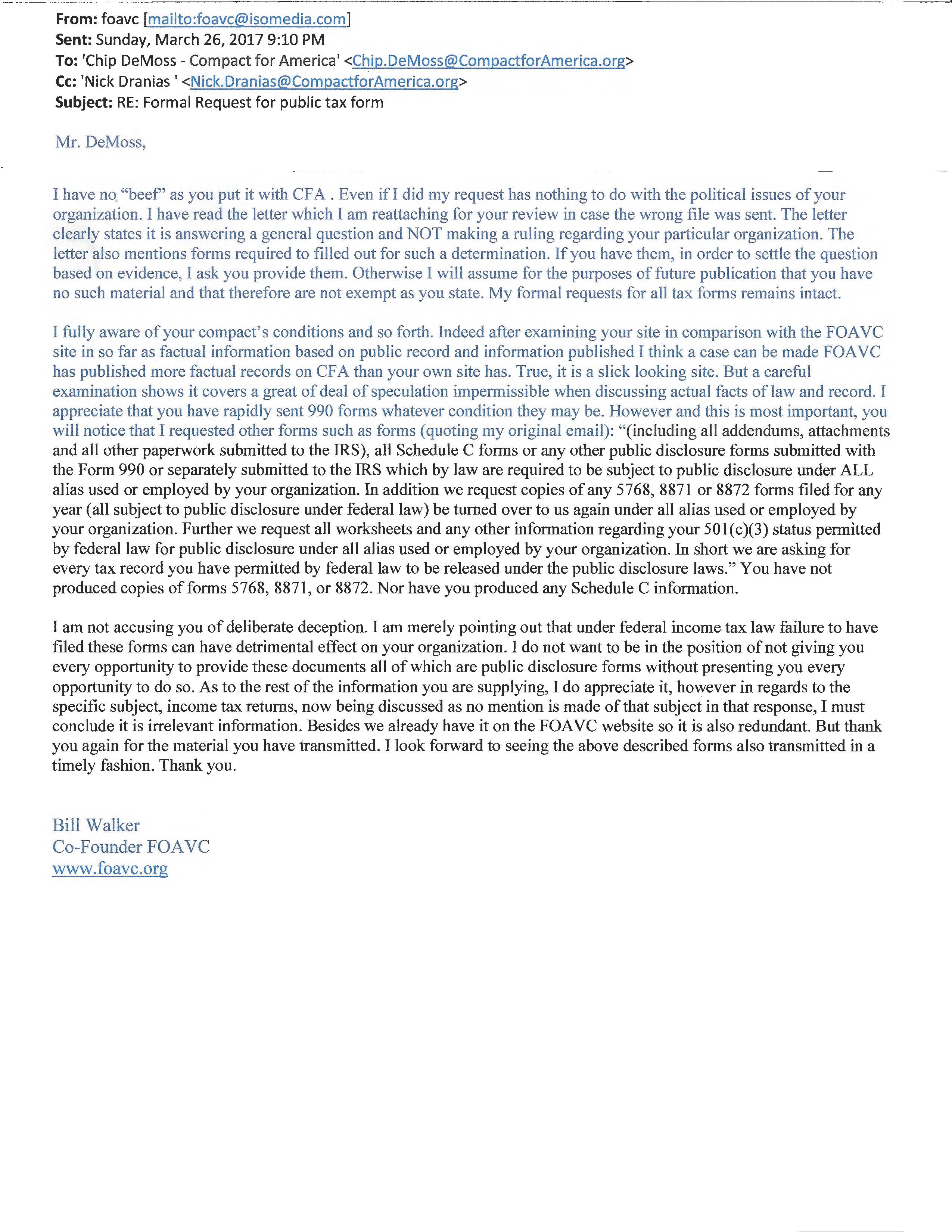

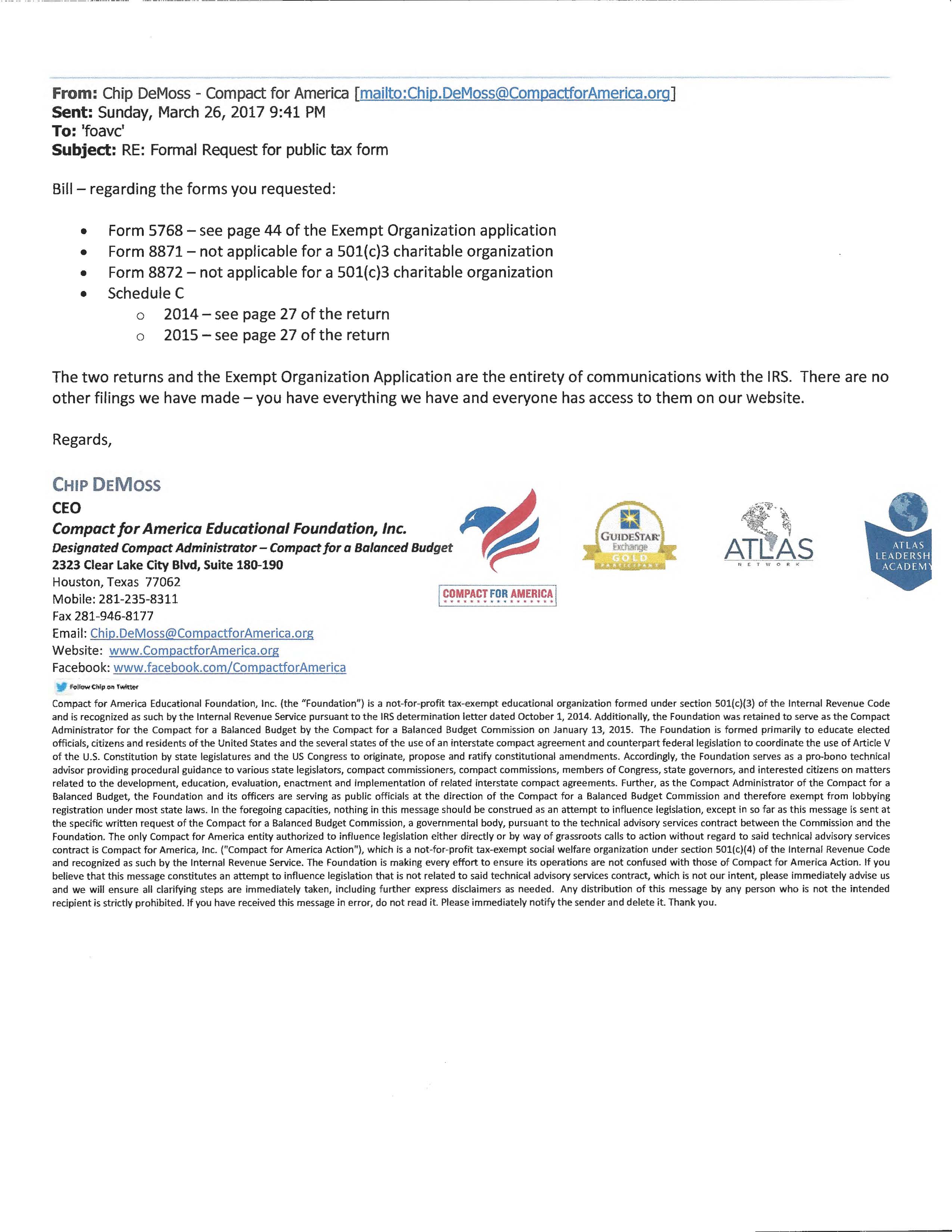

CFA -- Chip DeMoss Emails

|

|

|

|

|

|

|

|

|

|

|

|

PDF File--Chip DeMoss Emails

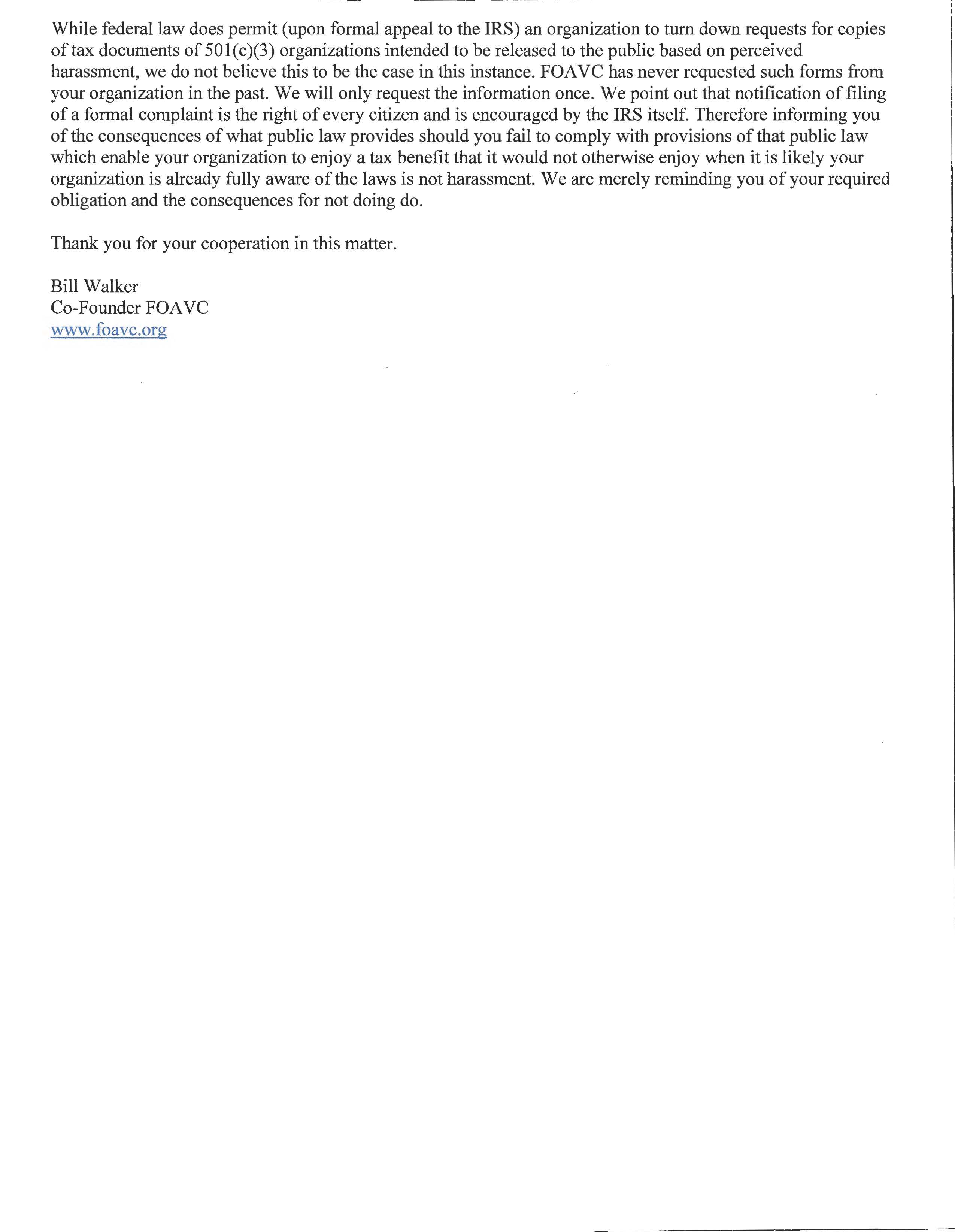

COS -- Robert Kelly Emails

|

|

|

|

|

|

|

|

PDF File--Robert Kelly Emails

FOAVC Response to the COS Threat

Upon examining the COS tax forms FOAVC became aware of the millions of dollars COS has at its disposal. It became aware of the massive amount of money paid a few individuals in COS. Naturally these individuals wish to protect that income and therefore would react to any perceived threat to that income. FOAVC became aware of the massive financial resources of political groups backing COS (in excess of a billion dollars). FOAVC became aware of the one million dollars paid in legal fees to its legal advisers (one fifth of the COS reported income for the tax year 2015). FOAVC is aware of the perceived political power this 30,000 volunteer organization (approximately 600 people per state) believes it possesses over the American public. FOAVC is also aware COS claims to have over two million volunteers but has produced no evidence to support this claim.

FOAVC does not take threats lightly. In response to this COS threat, FOAVC will report only the financial facts of public record as stated by COS/CFA in their tax forms together with such other factually based information as relates to the subject being reported. As with all information FOAVC publishes, the information provided will be fully referenced. FOAVC will then present conclusions or raise questions which can be reasonably surmised from these facts of public record such as comparing statements made by COS/CFA in their public records with appropriate federal tax law, forms or requirements all of which is public record. We also reserve the right to examine other documents provided by COS/CFA in light of other laws such as applicable state law. In short we will report the facts and remain well within the parameters of reporting permitted by law.

FOAVC believes the information it is providing as well as its conclusions are well within the safe harbor afforded it by defamation laws. These laws, which vary from state to state, establish the legal standards under which a defamation suit may be instigated. Plaintiffs who are unable to satisfy these standards of law have no basis for a suit. The most important legal standard is the truth. Truth is considered an absolute defense in a defamation lawsuit. It need hardly be said in publishing public tax forms created by COS/CFA and comparing that information with public tax law FOAVC is obviously publishing the truth. This equally applies to the publication of other COS/CFA information and comparing that to other relevant public record or law.

Another standard of defamation is whether COS/CFA are what is termed "public figures" under defamation law. According to the Supreme Court, public figures must prove deliberate malice, that is a reckless disregard of the truth, in order to successfully sue for defamation. The expression, "reckless disregard of the truth" in simplest terms means a plaintiff, in order to be successful in any suit, must prove the alleged defamatory material was published with malice, that is, published by a defendant who knew the information was false and published it anyway. The public figure standard thus sets a higher bar for a plaintiff to satisfy in order to be successful in a suit.

FOAVC believes both Convention of States and Compact for America fall under the legal definition of "public figure" as defined by the courts which involves public figures voluntarily thrusting themselves into the vortex of public debate. Both organizations (including their officers and members) have clearly voluntarily "thrust" themselves into the "vortex of public debate." Both organizations have a political agenda which involves proposed amendments to the United States Constitution by an Article V Convention (or as COS phrases it, "a convention of states"). The Constitution is a public document affecting all Americans. Alterations to the text of the Constitution by means of amendment unquestionably are within the realm of public debate. Both organizations have either favored or helped create public laws regulating a convention for proposing amendments, one of the two methods of amendment proposal described in the Constitution. The affect of public laws are also unquestionably within the realm of public debate. Finally, comparing documented records of COS/CFA obtained from the organizations themselves with relevant documented public policy concerning statements made in those documents clearly is not a "reckless disregard for the truth."

It is indisputable COS/CFA have "voluntarily drawn attention to themselves as a fulcrum to create public discussion." Indeed, were it not for Convention of States and Compact for America backing or creating state laws intended to remove the people's right to directly vote on delegate selection for a convention the issue would not exist. The fact is not only are COS/CFA in the vortex of public debate, they created the vortex in the first place.

Moreover blatant efforts of Convention of States to seek applications and favorable laws regulating a convention to achieve their political goals or Compact for America seeking a "compact" with the same intent clearly thrust these organizations "into the vortex of the public issue and engage the public's attention in an attempt to influence its outcome." Members of COS and CFA have testified at countless public hearings of various state legislatures identifying themselves as representatives of their respective groups with the stated intent of influencing legislative decisions on applications or state laws. (Examples: CFA_Arizona; COS_Illinois; Nevada; Ohio; Utah). There is no malice in discussing public records of these organizations or examining them in light of other public records or public policies. Therefore any threat of retaliation by COS made against FOAVC for examination of their public records and making comments on those public records is groundless.

COS is not the only organization that can hire lawyers. "Examination of public records, particularly those obtained as a result of a voluntary decision on the part of the party which results in the creation of public records subject to public examination as required by law, is not actionable. The law created by Congress (and by the states) requiring inspection of public records was done with the intent of permitting the general public the opportunity to be aware of matters of public policy. Public inspection laws carry with them an implied immunity from legal retaliation by those who, for whatever purpose, seek to deny the public the right of inspection of records designated as "public records" thus preventing the public access to the information contained within those public records. Were denial possible when otherwise required by law, such a action would have a chilling effect on the First Amendment right of the people to know how their government functions and thus able to make informed decisions regarding that government. Efforts to curtail this right can be actionable against those parties who either threaten or attempt to coerce a member of the public from exercising this right. This is certainly true in the case of anyone acting in the capacity of what can be broadly termed, "journalistic reporting" whose purpose is to report information contained in public records to the general public and thus bring to their collective attention matters which might otherwise go unnoticed."

The obvious reluctance of these organizations, particularly Convention of States, to permit public inspection of their financial records as permitted by law, clearly reflects their political viewpoint: exclusion of the American people entirely from the COS agenda which is to assume control of the federal amendatory process and advance their political goals. Whether reporting the facts of public record affects the "good name" of Convention of States is up to the American people to decide. The public records FOAVC presents have been available on the Internet or obtainable on request since 2010 when COS was formed. Frankly, any allegation by Convention of States that a report by FOAVC on the finances of that group is the single factor which will affect the "good name" of COS is ludicrous.

COS/CFA Internet Traffic Records

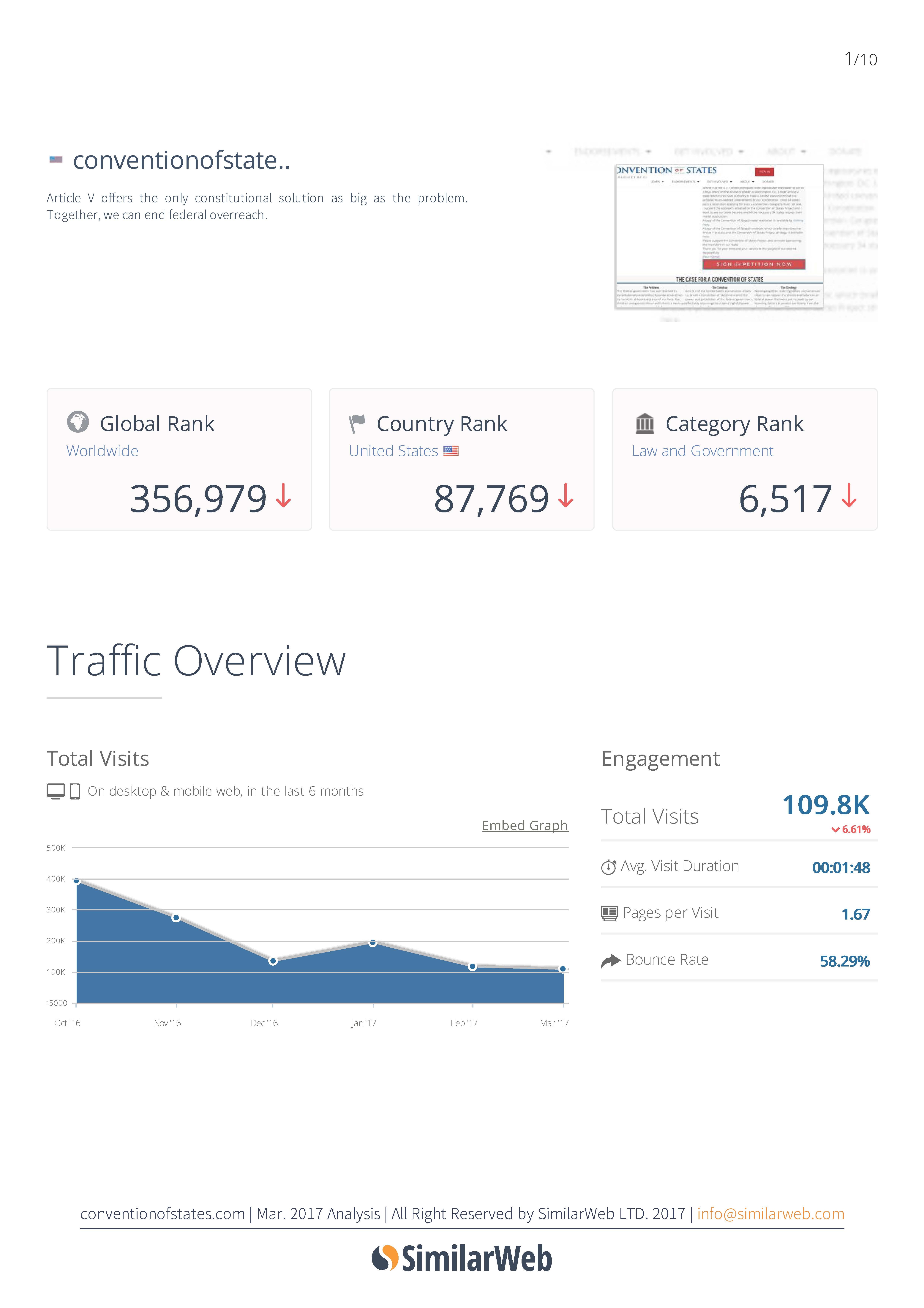

If Internet traffic is any indication, the American people appear to have already decided about COS/CFA. According to a March, 2017 market analysis by

SimilarWeb, an Internet marketing site, support for

Convention of States wained markedly in the six months previous (Click image left to enlarge). SimilarWeb

tracks monthly traffic for an Internet site and ranks sites according

to their traffic globally, by country and by subject category.

SimilarWeb provides a six month chart showing traffic trends for a

site. Generally the information is used for advertising purposes but the figures

serve equally well to judge the success of a political site. The

figures may also be used to support or refute certain claims made by an

Internet site such as the claim by COS it has two million volunteers meaning two or more million visits to its site.

If Internet traffic is any indication, the American people appear to have already decided about COS/CFA. According to a March, 2017 market analysis by

SimilarWeb, an Internet marketing site, support for

Convention of States wained markedly in the six months previous (Click image left to enlarge). SimilarWeb

tracks monthly traffic for an Internet site and ranks sites according

to their traffic globally, by country and by subject category.

SimilarWeb provides a six month chart showing traffic trends for a

site. Generally the information is used for advertising purposes but the figures

serve equally well to judge the success of a political site. The

figures may also be used to support or refute certain claims made by an

Internet site such as the claim by COS it has two million volunteers meaning two or more million visits to its site. According to the March, 2017 analysis Convention of States has a global ranking of 356,979 among the over one billion global Internet sites and is trending downward. In 80,818,367 United States websites Convention of States is ranked 87,769 and trending downward. In the category of law and government websites, COS ranks 6,517 among all Internet sites related to law and government and is trending downward.

Internet traffic to the COS site has dropped precipitously in the last six months. According to the SimilarWeb report, in October 2016, the Convention of States site had 400,000 visitors a month. By March, 2017 the number of visitors to the COS site had dropped to just over 109,000 visitors a month. This translates to a drop in traffic to the COS website of nearly 73 percent. SimilarWeb does not state why the COS website site has lost nearly three fourths of its Internet traffic. The most likely answer is the American public has rejected the political proposition of COS control the amendatory process rather than by the American people. Possibly contents of COS tax forms already reported by other websites may have played a part in this decision by the American people.

In any event FOAVC cannot be blamed for any affect on the "good name" of COS due to discussion of their finances because whatever effect such reports may have had occurred long before this FOAVC report, as indicated by the date at the bottom of this page, was released. More recent SimilarWeb reports (May, 2017) show the COS site has essentially remained unchanged. As such any changes in global ranking, United States ranking and law and government sites ranking is explained, not by an increase in popularity, but for other reasons such as a drop in total Internet sites. (Both CFA and COS reports have been modified by FOAVC to the extent of inserting hand written text showing the month and year of the graph for purposes of readability).

Internet traffic for Compact for America (May, 2017) while showing a one month increase in traffic, remains minimal. CFA has a global ranking of 1,834,885, a United States ranking of 485,161 and ranking in "News and Media" of 64,032. SimilarWeb apparently does not believe the CFA website has anything to do with law and government.

The COS/CFA Tax Forms--Introduction

As anyone knows who has done his federal income tax return, federal tax law is complex. This complexity is equally true for tax exempt organizations such as Convention of States and Compact for America. The tax forms of COS and CFA were prepared by professional tax preparers who obviously are expected to know and understand the federal tax law. Federal tax law is clear however: regardless of whoever fills out the income tax forms, the person or organization whose taxes are being reported is responsible for the content of the form. The IRS has a tax form for everything and requires anyone filing an income tax return of any description complete all required forms fully, correctly and truthfully. Failure to do this may violate federal income tax law. Whether a violation has occurred is determined by an investigation conducted by the Internal Revenue Service. Despite whatever assertions of inapplicability Convention of States or Compact for America may make regarding federal income tax, the requirements of the law equally apply them as with any other American citizen or organization filing federal income tax.

FOAVC claims no special expertise regarding federal income tax law. Like the average American earning $21.62 an hour ($865.00 a week), the average hourly wage according to the April 18, 2017 Bureau of Labor Statistics report, FOAVC reads the IRS publications and takes the information contained therein at face value. One thing is clear from reading those publications: if someone makes a claim involving federal income tax the IRS requires specific forms to be submitted in order to substantiate the claim. The IRS appears to have a form for everything and specific procedures for processing claims that require submission of specific forms in order to be processed. Under federal law if these processes are not followed or forms not submitted, the claim is invalid.

FOAVC believes it is entirely proper to raise questions about the public tax records of COS/CFA if for no other reason that, in some instances, the statements by COS/CFA and the federal tax exemption laws appear at odds. As tax law is difficult to understand, where appropriate in order to explain details of the law, FOAVC has published copies of IRS online publications, website information or tax forms providing direct quotes from the IRS about income tax law. We emphasize raising questions or making comments regarding expenditures, tax forms and so forth of COS/CFA does not suggest or imply either organization has violated federal income tax law. Only an investigation by the Internal Revenue Service can determine that fact.

Nevertheless based on the emails reprinted above it is apparent these organizations do not want anyone "poking around" in what they obviously believe is their private business. These organizations voluntarily chose to operate under federal tax laws granting them certain tax advantages in the form of tax exemptions. Part of the price for taking advantage of those tax benefits is the requirement to provide public tax records on request together with other limitations imposed on them by federal tax law, such as requiring these organizations present their public information in a prescribed manner. The tax laws place requirements on CFA/COS which, when compared to the statements of COS/CFA, raise questions. The privilege of tax exemption carries with it the risk of public inquiry and investigation. If CFA or COS desired absolute privacy regarding their tax records they should have elected to remain private organizations and paid their income taxes like everyone else.

FOAVC believes anyone examining

a

public record who concludes that record presents impropriety are duty bound

as good

citizens to report this belief to the proper

authorities for investigation. Many federal and state government organizations provide easily accessible contacts a citizen may

use bring matters of concern to the attention of the government authority

concerned with that public record. The

Internal Revenue Service, for

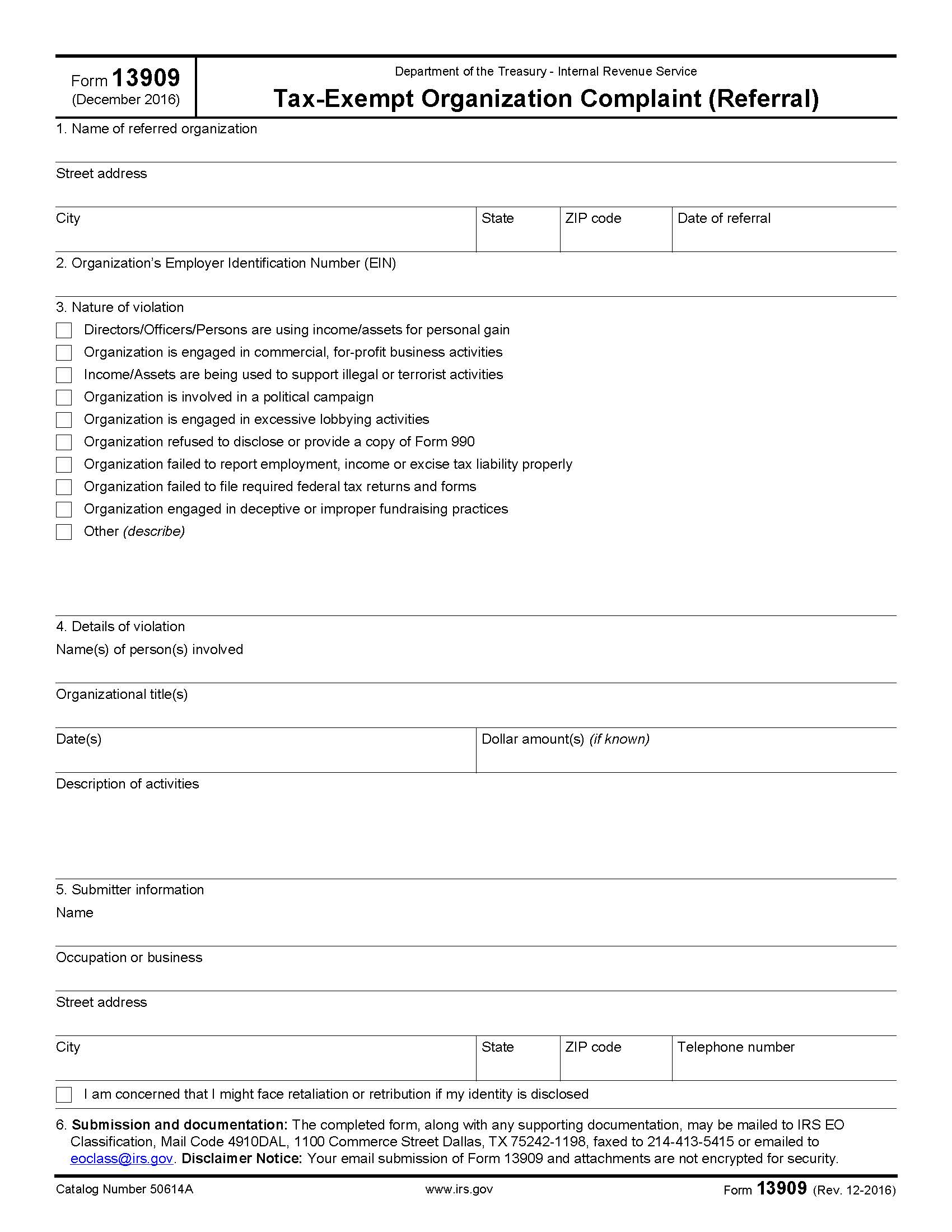

example, encourages reporting by citizens

who believe tax improprieties (called "referrals" by the IRS) have

occurred to report these concerns to the IRS (click on image left to

enlarge). The IRS provides several forms which the public may use

to report income tax concerns to the Internal Revenue Service. In the

case of 501(c)(3) and 501(c)(4) tax exempt organizations reporting of

such concerns is accomplished by submitting Form 13909 (click

on image right to enlarge) to the appropriate Internal Revenue Service office shown on the form. The form may be emailed, faxed or mailed to the IRS.

FOAVC believes anyone examining

a

public record who concludes that record presents impropriety are duty bound

as good

citizens to report this belief to the proper

authorities for investigation. Many federal and state government organizations provide easily accessible contacts a citizen may

use bring matters of concern to the attention of the government authority

concerned with that public record. The

Internal Revenue Service, for

example, encourages reporting by citizens

who believe tax improprieties (called "referrals" by the IRS) have

occurred to report these concerns to the IRS (click on image left to

enlarge). The IRS provides several forms which the public may use

to report income tax concerns to the Internal Revenue Service. In the

case of 501(c)(3) and 501(c)(4) tax exempt organizations reporting of

such concerns is accomplished by submitting Form 13909 (click

on image right to enlarge) to the appropriate Internal Revenue Service office shown on the form. The form may be emailed, faxed or mailed to the IRS.  The IRS investigates all referrals sent to it. As prescribed by federal law the

results of these investigations are

confidential. Referrals may be submitted anonymously. Anyone reporting a referral

to the Internal Revenue Service

who provides their name and address will receive a letter of

acknowledgment of

receipt of the referral but no further information as to the outcome of

the referral. Referrals

regarding tax exempt organizations often are accompanied with throughly

researched and detailed supplements providing the IRS extensive

information about the activities of the organization in question. An

example of a supplement sent the IRS in a referral complaint can be read by clicking on the image left. The example is the only

one FOAVC could find posted on the

Internet and was furnished for illustrative purposes only. FOAVC has no position regarding the information contained within the example supplement.

The IRS investigates all referrals sent to it. As prescribed by federal law the

results of these investigations are

confidential. Referrals may be submitted anonymously. Anyone reporting a referral

to the Internal Revenue Service

who provides their name and address will receive a letter of

acknowledgment of

receipt of the referral but no further information as to the outcome of

the referral. Referrals

regarding tax exempt organizations often are accompanied with throughly

researched and detailed supplements providing the IRS extensive

information about the activities of the organization in question. An

example of a supplement sent the IRS in a referral complaint can be read by clicking on the image left. The example is the only

one FOAVC could find posted on the

Internet and was furnished for illustrative purposes only. FOAVC has no position regarding the information contained within the example supplement. FOAVC has reprinted all tax information sent to them by CFA and COS. For purposes of discussion we present extracted pages from the tax forms or other information in which we may highlight certain information provided in the tax returns. We have also reached out to other Internet resources clearly identified in the information we present. In some instances the material sent us by CFA and COS is duplicated by these other sources. FOAVC believes in the case of financial information cross checks are important.

Statements in Rebuttal

Naturally FOAVC invites Compact for America and Convention of States to respond to our inquiry of their financial records. FOAVC will publish any response from these organizations on a separate page of this site. However, such responses must be to the standards established by FOAVC on its website. To be blunt, neither CFA or COS has demonstrated any consistent track record regarding accurate, referenced information. As we have demonstrated elsewhere on this site many of the political statements made by COS/CFA are easily refuted by public record raising questions of consistency and accuracy. In addition, both organizations have ignored public record when such record contradicts or disproves their political agenda. Such conveniences are unacceptable to FOAVC particularly in discussing finances and federal tax law or other laws.

Therefore FOAVC will only publish responses by COS/CFA if they are fully referenced. We define "fully referenced" as providing documented evidence which prove the statement made in rebuttal is factually accurate. FOAVC reminds both organizations that in its original email requesting "all" public tax records be sent to it, both organizations stated that the records sent were complete. Thus, production of "new" tax records must therefore be viewed skeptically. If it is asserted in rebuttal, for example, that a particular tax form was submitted to the IRS where the information provided by COS/CFA appears to indicate otherwise, that form must be produced, permission granted to publish it, together with all financial evidence related to that tax form including proof the form or information in question was actually supplied to the Internal Revenue Service or other appropriate governmental unit.

Further an explanation as to why the form was not produced when first requested must accompany the form with the clear understanding this explanation will be published. If it is asserted a particular part of the tax code favors or explains an action of the organization, that code must be cited, quoted and sourced meaning providing a source whereby the public can examine the reference independently. A generalized reference, such as referring to an entire section of the IRS code with the obvious expectation that FOAVC (or the public) then spend hours sifting through pages of regulation, (with the obvious expectation few will do this), is unacceptable. The source must be precise and able to be immediately located. If a court ruling permits the action in question, that specific ruling must be provided, cited and sourced.

Unreferenced, undocumented statements, such as emails stating FOAVC is incorrect which provide no evidentiary proof, statements made by volunteers online or repeating statements already asserted in public that do not provide documented evidence, will not be published. FOAVC will not accept editorial columns, Facebook or any other social media opinions or statements or excerpts from the website of either organization as evidential proof. Such opinions are clearly political in nature and have nothing to do with the financial or tax records of either organization. Nor will we accept a generalized link to the organization's website as a whole. We also expect in making its rebuttal COS/CFA will publish our investigation (in full) on their website for the purposes of full disclosure. Failure to do this will cause us to remove any page published on our site regarding an COS/CFA rebuttal or not publish the rebuttal in the first place.

Access to Tax Records of Compact for America and Convention of States

The tax information for Compact for America and Convention of States are presented in separate introduction pages. Links to the individual tax years for each organization are provided on that introduction page. Concerns and questions associated with the information contained in that year's tax return will be addressed on the individual tax return page or on the introduction page. The introduction pages for each organization can be reached by clicking either of the following links: