Compact For America(Action), Compact for a Balanced Budget Commission

FOAVC can locate no federal income tax record for Compact for America(Action) for tax year 2015. There is no record the organization was disbanded. According to IRS regulations disbanding a 501(3)(c) organization requires notification to the Internal Revenue Service by use of the same 990 form used to report the federal income tax of the exempt organization.

The only record associated with the Internal Revenue Service FOAVC has been able to locate regarding the Compact for a Balanced Budget Commission is an Internal Revenue Response letter posted on the Commission website which states the Internal Revenue Serive has no record of the governmental status of the Commission. The letter further states the response letter being sent by the IRS does not establish this status and is provided purely for informational purposes. The letter suggests if the Commission wishes to establish its governmental status it may apply via a process described in the letter. FOAVC has been unable to locate any other tax records of the organization Compact for a Balanced Budget Commission.

Compact for America Educational Foundation, Inc.

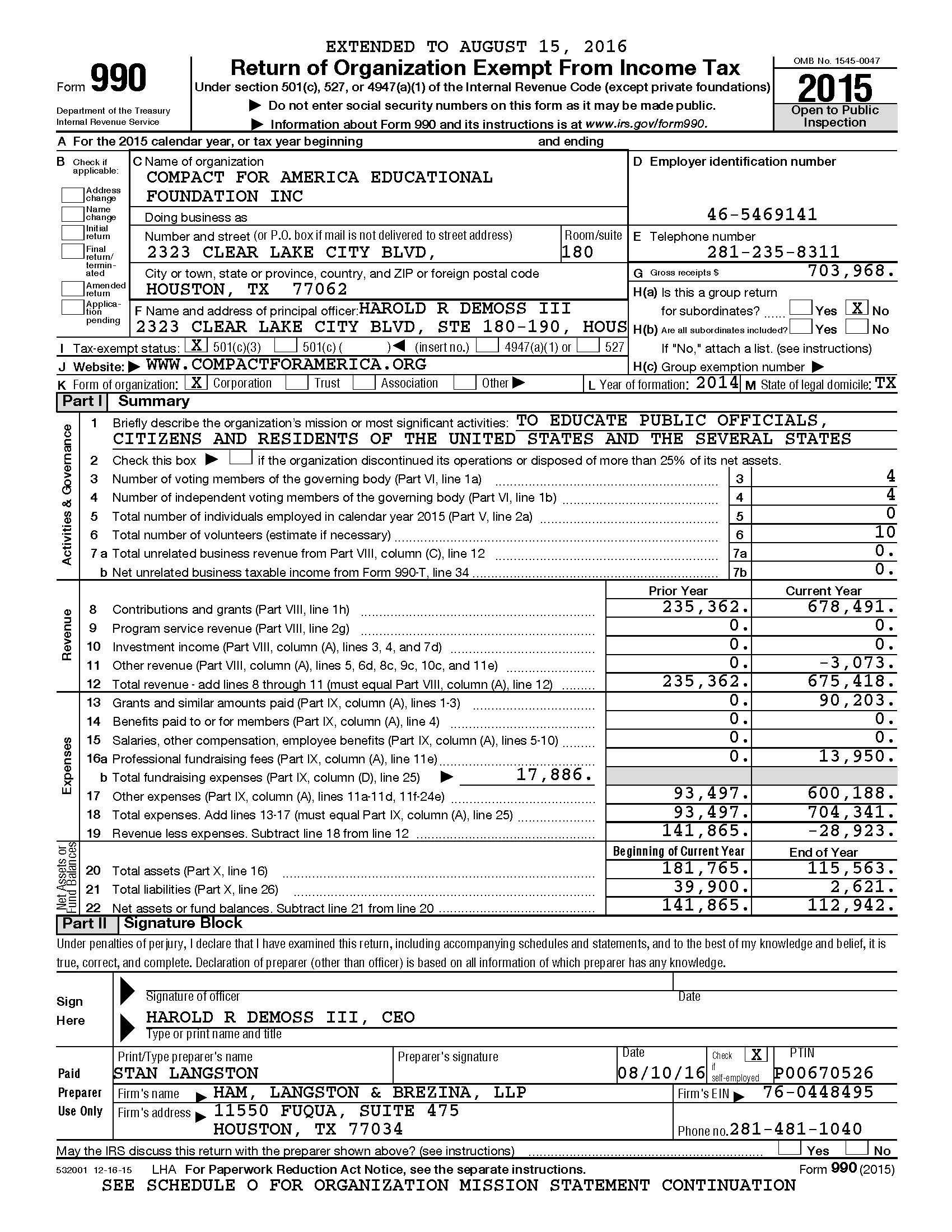

Compact for America Educational Foundation, Inc., filed

a 45 page tax return for tax year 2015. The 2015 CFA tax form essentially duplicated its 2014 tax return

except for changes in figures and slight variations in language. Copies of tax pages shown below are

taken from the CFA tax form and are highlighted as appropriate. As it had in 2014 the

Foundation reported

a total of 10 volunteers for Compact for America. Gross receipts rose

from $235,362 to $703,968; assets from $141,865 to $112,942 for tax

year 2015. The change in income is explained by a donation of $500,000

for tax year 2015. Subtacting this amount from the 2015 figures shows

the income of Compact for America actually was less in 2015 than the

previous year.

Compact for America Educational Foundation, Inc., filed

a 45 page tax return for tax year 2015. The 2015 CFA tax form essentially duplicated its 2014 tax return

except for changes in figures and slight variations in language. Copies of tax pages shown below are

taken from the CFA tax form and are highlighted as appropriate. As it had in 2014 the

Foundation reported

a total of 10 volunteers for Compact for America. Gross receipts rose

from $235,362 to $703,968; assets from $141,865 to $112,942 for tax

year 2015. The change in income is explained by a donation of $500,000

for tax year 2015. Subtacting this amount from the 2015 figures shows

the income of Compact for America actually was less in 2015 than the

previous year.In its Statement of Program Service Accomplishments (Page 2 of the tax form) the Foundation again lists one item: to give "educational presentations" at two "public policy and philosophical conferences in Las Vegas, NV and Washington DC." The tax form requires Compact for America "describe the organization's program service accomplishments for each of its three largest program services, as measured by expenses." As it did in 2014, Compact for America lists no other service accomplishments for tax year 2015 other than stating, "The Foundation's educational team researched and wrote nonpartisan policy papers...to advance the Foundation's mission." FOAVC's research indicates the "nonpartisan policy papers" used "to advance the Foundation's mission" also may not have complied with IRS non partisanship regulations. The papers appear to fail the required equally presenting both sides of an issue standard mandated by Internal Revenue Service regulations.

The 2015 CFA tax form contains a required Statement of Functional Expenses (Page 10 of the tax form). This form itemizes the expenses for the program services accomplishments described on Page 2 of the tax form. As only one accomplishment is listed by CFA presumably all expenses for CFA refer to that one accomplishment described on Page 2 of the tax form which was to attend two "public policy and philosophical" conferences in Las Vegas and Washington DC as no other accomplishment is described.

In 2015, Compact for America listed $90,203 given in grants to "domestic organizations and domestic governments" leaving a total of $569,498 expended to attend two "public policy and philosophical" conferences in Las Vegas and Washington DC. Page 36 of the 2015 tax form states $88,500 was given to Compact for a Balanced Budget Commission whose address (2323 Clearly Lake City Blvd., Ste 180-190, Houston, TX 77062) is same address listed on the 2015 income tax form for Compact for America. The form does not disclose dispensation of the remaining $1,703 "given to domestic organizations [or] domestic governments."

As in 2014, the itemized statement lists the $236,000 in management expenses (an increase from $44,900 in 2014) under the "program service accomplishments" which was singularly described on Page 2 of the tax form as attending two conferences in Las Vegas and Washington DC. Therefore the itemized statement reveals Compact for America paid two CFA managers $236,000 for the sole purpose of attending two "public policy and philosophical" in Las Vegas and Washington DC. If this were otherwise, the itemized statement would show partial amounts of the $236,000 in other columns, such as "management and general expenses" of Page 2 would have listed additional accomplishments of CFA. No such figures are shown nor are any other accomplishments described. While the tax records shows the two managers, Nick Dranias and Chip DeMoss were paid nothing directly by CFA, tax records also show companies exclusively controlled by these two individuals were paid a total of $236,000 in management compensation fees.

The cost for writing "nonpartisan" policy papers appears to be listed under "educational communication" rose from $750 in 2014 to $125,623 in 2015. Assuming work on the "educational communication" required 40 hours a week for 52 weeks, according to the CFA tax form, an unnamed individual was paid $2,415 a week (or $60.40 an hour) to write the material. As this amount is listed separately from the $236,000 spent for management expenses, it must presumed this expense relates to a payment made to an unnamed individual who wrote the "nonpartisan" papers. If the managers had written the papers themselves or the money referred to a time estimate the $125,623 would have been listed in the "management and general expenses column" of the form rather than the "program service expenses" column. Presumably, the $31,881 for 2015 printing expenses (up from $9,068 in 2014) refers to printing costs for printing the "nonpartisan" papers presented at the two "public policy and philosophical" conferences in Las Vegas and Washington DC.

The tax form lists a cost of $45,250 in "memberships" which apparently refer to membership fees related to the two conferences in Las Vegas and Washington DC. No "membership" fee was described in 2014. As no other accomplishments are described on Page 2, these "memberships" can only relate to the single accomplishment mentioned. It can therefore can be stated the two CFA managers were each charged $22,625 in membership fees to attend the two conferences in Las Vegas and Washington DC.

The itemized statement shows a total of $569,498 was spent to accomplish the program service accomplishment described on Page 2 of the CFA tax form as attending two "public policy and philosophical" conferences in Las Vegas and Washington DC. The expense is itemized as $236,000 for management expenses, $103,584 in travel expenses, $27,150 in conference, conventions and meetings costs, $31,881 in printing costs, $45,250 in membership fees and $125,633 for "educational communication" to attend the conferences.

According to the tax form the cost for presenting CFA material (booth space rental) at the two conferences rose from $10,033 in 2014 to $27,150 in 2015 or or approximately $13,575 per conference, presumably to reserve presentation or booth space at the two conferences. Travel expenses for the two CFA mangers rose from $24,568 (or an average of $12,284 for each individual to attend the two conferences) in 2014 to $103,584 in 2015 or $51,792 for each individual to attend the two conferences.

While costs may have slightly changed between 2014 and 2015, the numbers are still valid. According to Internet sources:

Average cost of a hotel room per night in Las Vegas in 2014 was $116.00 or $232 for two people;

Average cost of a hotel room per night in Washington DC was $243 or $486 for two people;

Cost of a nonstop flight from Houston TX (headquarters of CFA) to Las Vegas (round trip) $622 or $1244 for two people;

Cost of a nonstop flight from Houston TX (headquarters of CFA) to Washington DC (round trip) $367 or $734 for two people;

Average cost of a restaurant (in the casinos) in Las Vegas $50.00 a person or $150 a day per person or $300 for two people;

Average cost of restaurant in Washington DC is $70.00 a person or $210 a day per person or $420 for two people.

Summation:

Cost of two round trip tickets to Las Vegas, $1244, Daily costs for two: hotel rooms $232; meals $300. Total daily expenses = $532.

Summation:

Cost of two round trip tickets to Washington DC, $734, Daily costs for two: hotel rooms $486; meals $420. Total daily expenses = $906.

Based on the information in the 2015 tax report, approximately $1,978 dollars was spent in airline travel by Compact for America to fly its two managers to Las Vegas and Washington DC. Subtracting the $1,978 from the total reported expenses of $103,584 for the two conferences leaves $101,606 or $50,803 in expenses for each the two CFA representatives while attending the conferences. Assuming half of the $50,803 was spent on each trip ($25,401) and based on the daily total expenses divided into the $25,401 to obtain the days spent in each city, CFA reported to the IRS that its two managers were paid $236,000 to spend 47 days in Las Vegas at a "public policy and philosophical conference" and 28 days in Washington DC at a similar conference.

Page 2 of Schedule C of the tax form states $704,341 was spent for "exempt purpose expenditures." The form further states that zero money was spent on lobbying expenditures to influence public opinion (grass roots lobbying) and zero amount was spent to "influence a legislative body (direct lobbying). On Part IV, Schedule C (Page 3) Compact for America affirms this statement saying, "No political campaign activities took place during the year." According to public record the states of Mississsippi and North Dakota enacted laws to become the third and fourth states to join the Compact for Balanced Budget. Mississippi joined the compact on March 13, 2015; North Dakota joined on April 1, 2015. Compact for America is on record as having written the compact which was enacted by these two states.